Payroll Bureau Software

Cut Costs. Save Time. Streamline Payroll.

Are you looking for a cost and time-effective payroll bureau service that will make processing your organisation’s payroll as easy as possible? Would it help to be able to make changes as late as 2 days before pay day?

If so, then our cloud payroll service is exactly what you need.

Our custom-built cloud payroll bureau software, Legislator™, is easy to use and will save you time, cut costs and eliminate all the pain associated with running your payroll.

Benefits of Our Payroll Bureau Software

Effortless Payroll Management

You simply access your employee records online, make any required payroll data changes, and then click the button to notify us to start processing.

Using our payroll bureau software gives you full visibility of your payroll data in real time, so you can make informed decisions before final submission.

Fully Supported Payroll Processing

- One click and we take over: Submit your variable pay changes, then relax while we do the rest.

- Dedicated payroll expert: Your payroll qualified CPS Account Manager applies HMRC tax-code changes, student-loan notifications and pension auto enrolment actions and calculates the payroll. Draft reports are then typically uploaded to your inbox within 30 minutes.

- Everything else handled: once late adjustments and amendments have been notified we then process the final run and transmit your RTI files to HMRC, send employees net pay via Bacs, issue P45s, upload pension data and even remit third party payments for liabilities such as PAYE and AEO deductions. Every deadline is met without you lifting a finger.

Our dedicated support team is always on hand to assist with support and any payroll queries that crop up.

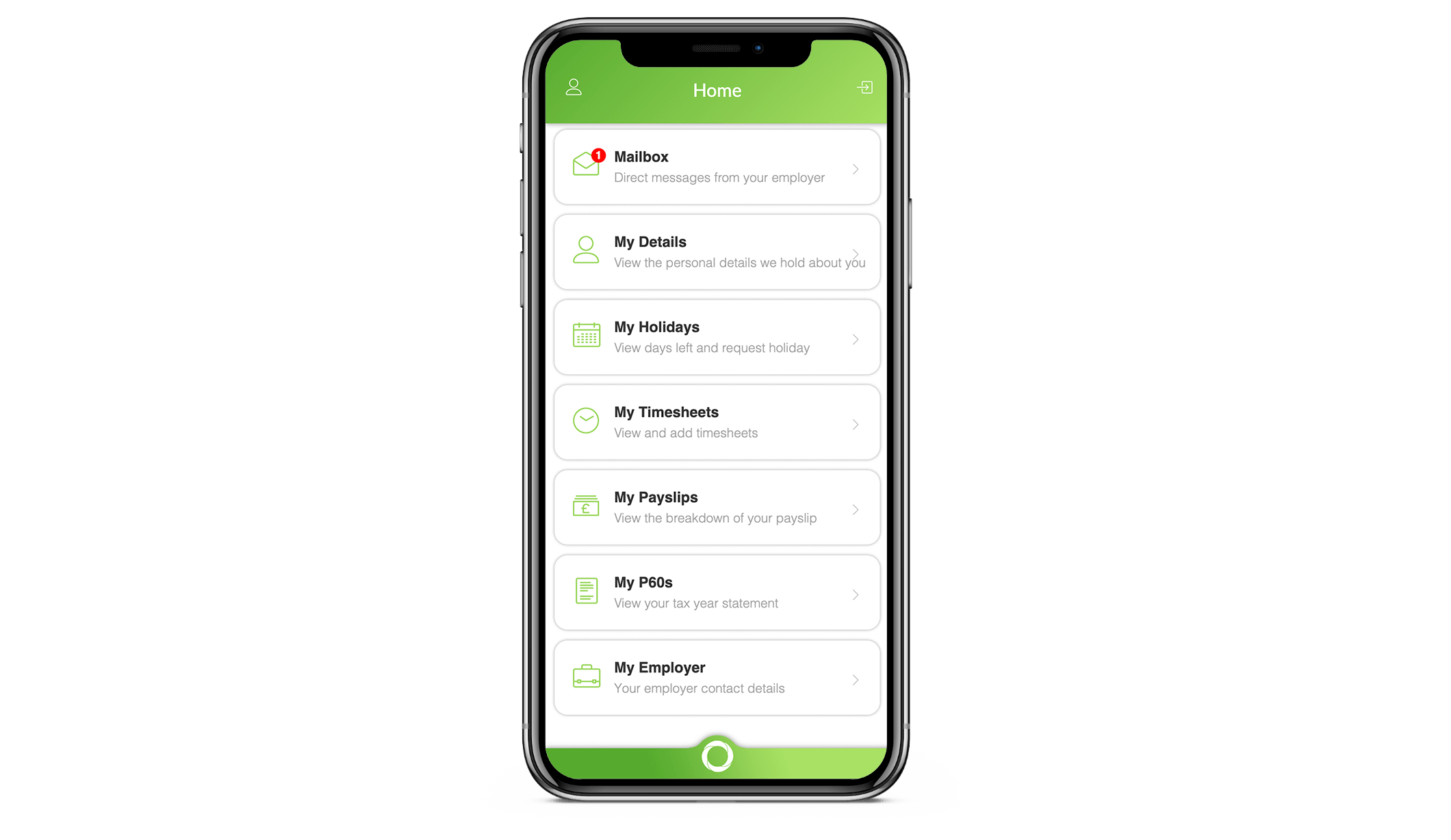

Employee Self-service

Employees get instant access to payslips, P60s and P45s via a slick smartphone app or web portal, while managers can approve holiday requests through the integrated HR module. This self-service hub eliminates routine queries and paperwork, keeping payroll and HR admin stress-free.

Increase Payroll Accuracy

Our cloud-based payroll bureau software uses built-in validation and compliance checks to boost accuracy and cut errors. Continuous HMRC updates keep every payroll run fully compliant and audit-ready.

What Customers Are Saying About Payroll Solutions

Customers have praised our payroll bureau service for its ease of use, reliability, and exceptional support.

“I have confidence in being 100% compliant in all aspects of payroll, pensions, HR, data protection and other related areas. We’ve saved a huge amount of time that would otherwise have been lost to processing – at least three days a month if not more.” — Chief Financial Officer at Miles and Miles Ltd, Purdey Wildey.

Intuitive, Highly Secure Payroll Software

Accessible 24/7 From

Any Location

Our payroll management software is cloud-based, you will not need to physically install the software – you simply need a web browser to access it.

Our payroll bureau software is trusted by accountancy firms across the UK who rely on secure, accurate payroll runs every month.

Cloud payroll software is straightforward to implement too, ensuring a smooth transition within a short time frame and minimising any disruption to your processes and business.

Once the desktop payroll software is up and running you will then be able to process your company’s payroll securely from any location with an internet connection.

With our cloud payroll bureau software, you can access your payroll data securely from any location, backed by robust multi-factor authentication.

That enables you to generate reports or make changes 24/7 to suit you.

Streamlined Integration with HR Business Software

Our accounting platform is built for easy integration, so you can link it to other finance tools whenever you need to.

If you plan to upgrade both HR and payroll, pairing HR Legislator with Payroll Legislator gives you a single, joined-up system that cuts costs and boosts efficiency.

We keep Legislator Payroll constantly current—every release meets the latest HMRC rules and the highest security standards.

Ongoing R&D means you always run the most secure, fully compliant version.

Interested? Get in touch and we’ll show you how it works.

Key Features

The Legislator software is also completely scalable. Our clients’ businesses range in size from 100 to 15,000 employees so you can have the confidence that it can be readily scaled up to accommodate business growth if required. Some of the unique advantages of choosing our automated payroll services are:

Fast Data Migration

Guaranteed smooth transition from your old systems to our platform in a rapid time frame.

Automated Reports

Batch report manager to automatically create all payroll processing reports as part of the calculation run.

Easy Integration

No room for human error with unique automated features and seamless integration with our HR and best payroll software.

24/7 System Accessibility

Access the system to generate reports or make changes 24/7 from any location.

Customer Care

Highly trained and qualified support team to answer all your questions.

Free System Updates

Protected investment with our commitment to constantly keep the payroll system up to date.

Legislator Payroll Bureau Software

Our software is some of the best payroll software available. Our online payroll software is backed up by an exceptional level of attention to detail, top tier customer service, and constant investment in research and development. Backed by rigorous security and multi-factor authentication, it delivers peace of mind for employers and accountancy firms alike.

- Cloud-based – accessible from any location

- Unlimited pay and deduction codes

- Complete auto enrolment compliance for unlimited pension schemes

- No software to install

- Constant FREE updates

- New users can be added in minutes

- Real-time “always on” connection to HMRC

- Online self service portal for payslips and P60s

- GDPR compliant

Our payroll bureau software ensures that payroll calculations are processed quickly and accurately, helping businesses maintain compliance and employee trust.

Onboarding & Training

From the very first day, we provide a wide range of training courses to ensure your staff is getting the most out of our bespoke HR and Payroll software. We also provide a dedicated Payroll and HR software solutions consultant, to export data from existing databases, migrate it to your new platform and get you all set up and ready to roll.

Welcome

- Confirmation of your services

- Receive your planner deployment

- Agree a migration date

Setup

- Meeting with our CPS consultant

- Adapt the deployment plan to your needs

- Finalise the plan

Migration

- Handover and processing of your data

- Custom software development

- Finalise data migration

Training

- In-depth training on all key features

- Access to relevant online courses

- Accounts creation

Login

- Handover of all login credentials

- Finalise all product upgrades

- First demo run

Cloud-Based Payroll Software FAQs

Why is payroll software important?

This software handles math for wages, including bonuses and holiday or sick pay, making sure everyone gets paid the right amount on time.

It also eliminates the possibility of human error whilst complying with tax regulations, meaning less stress and less worry.

Can payroll software integrate with other systems?

Do I need payroll software for one employee?

This approach ensures accuracy in payment calculations, effectively eliminating concerns about potential human errors in the process.

Is fully managed or part-managed payroll outsourcing better for me?

This is especially beneficial if you lack the time or expertise to manage payroll tasks. On the other hand, part-managed services are great if you want to retain some control over certain payroll functions.

For small businesses, using payroll software for small business can offer a balance between control and convenience, allowing for more time to focus on business growth.

How much control will I have?

If you opt for a payroll management system or online payroll software, you’ll have more hands-on control over your payroll processes, with the ability to access and manage data anytime.

In contrast, fully managed payroll services offer less day-to-day control but ensure that all aspects of your payroll, including pension contributions, are handled by professionals. Remember, even with outsourced payroll, you’ll always have the final say in payroll decisions and oversight.

Do I need payroll software?

This compliance is key to maintaining accurate records and meeting legal requirements.

Using HMRC-compliant payroll software streamlines the process, reduces the risk of errors, and helps in keeping up-to-date with the latest tax laws and regulations.

How does payroll software save time for employees?

Payroll software can be automated and it takes into consideration your employees’ national insurance contributions, so your employees won’t have to manually calculate payroll.

Is payroll software easy to use?

As it’s a cloud-based payroll system, you can access your payroll system from anywhere with an internet connection, which is perfect for remote workers and businesses with multiple locations.

How long does it take to set up?

Generally, transitioning to an online payroll software or a payroll management system can take anywhere from a few days to several weeks.

The process involves migrating your payroll data, setting up employee details, and ensuring compliance with tax regulations.

What is the best payroll software for one employee?

What is the best program to use for payroll?

Payroll Solutions

Check our available Effective Payroll Solutions to see which one is most suitable for your organisation’s payroll needs.

CPS Payroll Bureau

This solution allows you to use our intuitive, highly secure and cloud-based payroll software, Legislator™.CPS Managed Payroll

Our team of payroll specialists will take care of everything, including input, calculation, processing and reporting. CPS

CPS CPS

CPS