Meet Your Workplace Pension Obligations

With Our Pension Auto

Enrolment Software

To limit the impact these issues can have on your business, our company has designed the most advanced Pension Enrolment Software to date. We can help you meet your legislative obligations with the minimum of effort on your part. Our auto-enrolment payroll bureau is straightforward to implement and ensures full pension auto-enrolment compliance.

Our workplace pension scheme software will accurately and reliably guide you through all of the auto-enrolment complexities to ensure your company is fully compliant with its pension obligations and meets all Pension Regulator requirements.

Our pension auto-enrolment software is designed for companies ranging in size from 100 employees to large organisations of up to 15,000 employees.

Pension Auto Enrolment Software by CPS

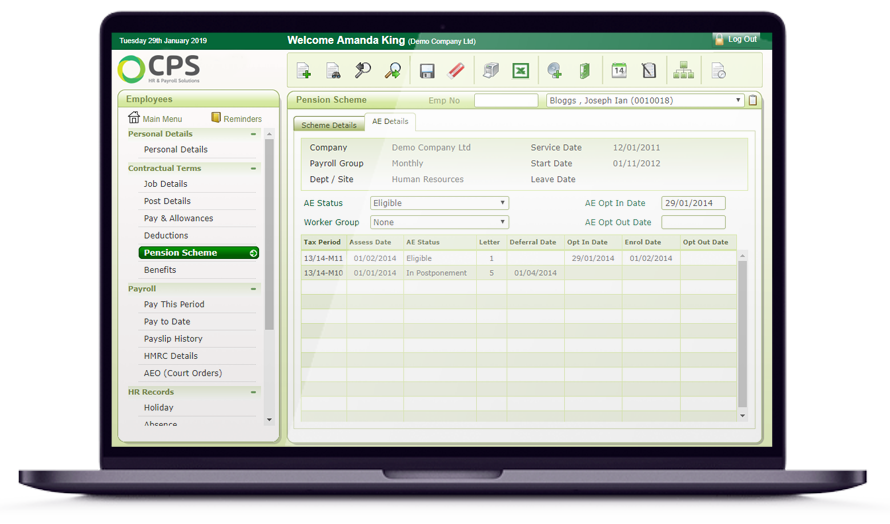

Our auto enrolment payroll software is specifically crafted to guarantee the smooth administration of your employees’ workplace pension scheme.

With each payroll cycle, our systems autonomously evaluate eligible employees, manage opt-outs, and streamline the enrollment process for those opting to participate in the scheme.

This efficient and dependable approach not only saves you valuable time and effort but also offers peace of mind in effortlessly managing your employees’ pension benefits through our automatic enrolment services.

What will happen once you’ve completed our assessment?

Once the assessment has been completed, the pension payroll software will deduct all necessary employee and employer pension contributions, refund any contributions following opt-out notifications and create the necessary communications for your employees as required by law.

The software also has the flexibility to cater for postponements and will conduct a re-enrolment assessment on a three yearly cycle. The pension auto-enrolment software can generate a full suite of reports, including those needed for pension providers, along with an employee history screen of assessment events and on-screen copies of employee communications.

Assesses Eligibility

Our auto-enrolment solution services automatically assess eligibility criteria as part of the payroll calculation process, ensuring accuracy and compliance with regulations.

Handles Opt-out and Opt-ins

When you choose us as your pension scheme auto enrolment software provider, you get a seamless solution to efficiently process both employee opt-ins and opt-outs of the qualifying workplace pension scheme.

Send Pension Information

Easily and securely transmit data directly to any pension software provider with just a few simple clicks, eliminating the hassle and streamlining the process.

Pension Enrolment Software

Our Pension Enrolment Software is designed to take care of the entire burden of automatic enrolment, ensuring you meet all of your company’s legislative obligations with the minimum of effort and without taking up excessive amounts of time. The software:

- Automatically assesses eligibility as part of the payroll calculation

- Caters for postponement

- Handles opt-out and opt-ins

- Creates all necessary employee communications each pay run

- Produces a suite of reports

- Conducts re-enrolment assessments on a 3 yearly cycle

- Is fully compliant with Pension Regulator requirements

Onboarding & Training

From the very first day, we will provide you with a wide range of training courses to ensure your staff know how to get the most out of your bespoke payroll software. You will be provided with a dedicated Payroll and HR software solutions consultant, who will work closely with you to export the necessary company data from your existing databases, migrate it to your new platform and get you all set up and ready to roll.

Welcome

- Confirmation of your services

- Receive your planner deployment

- Agree a migration date

Setup

- Meeting with our CPS consultant

- Adapt the deployment plan to your needs

- Finalise the plan

Migration

- Handover and processing of your data

- Custom software development

- Finalise data migration

Training

- In-depth training on all key features

- Access to relevant online courses

- Accounts creation

Login

- Handover of all login credentials

- Finalise all product upgrades

- First demo run

Pension Auto Enrolment Software - FAQs

How does pension auto-enrolment software work?

This convenient feature removes the requirement for individual employees to navigate complex administrative procedures independently, guaranteeing a hassle-free experience for all involved.

Who needs pension auto-enrolment software?

This crucial requirement ensures that individuals, including freelancers, the self-employed, and directors without an employment contract, have the opportunity to participate in this valuable scheme.

Our auto enrolment process is seamless and accessible to all.

Why is pension auto-enrolment software important?

Pension auto-enrolment is also a legal requirement and auto-enrolment payroll software is key in ensuring that all your employees are covered.

How can pension software save time for employees?

Our pension software streamlines the process, ultimately saving you time – and as the saying goes, time is money.

Is pension auto enrolment a legal requirement?

What is the difference between opt in and auto enrolment?

Our pension scheme auto enrolment software handles both processes efficiently. This feature is useful when integrated with payroll software, as it allows for seamless management of all employee benefits and contributions.

Does your pension auto-enrolment software integrate with other systems?

This ensures a streamlined and efficient process, allowing for easy management of employee benefits and payroll data. It also helps in accurately calculating pension contributions and keeps your records up-to-date.

With our auto enrolment services, you can effortlessly synchronise and consolidate crucial information, simplifying your administrative tasks and saving valuable time and resources.

Is pension software easy to use?

We provide comprehensive training and onboarding sessions tailored to your team’s specific needs, ensuring that they are fully equipped to maximise the benefits of our products.

Our goal is to provide you with a seamless and efficient experience, empowering your team to effectively manage their pensions and make informed decisions for their financial future.

How can you stay on top of the obligations concerning the workplace pension reform?

What can happen if you fail to stay on top of your pension schemes?

Automatic Enrolment is a crucial part of the Workplace Pension Reform, which affects every single employer in the UK. Failure to comply can result in substantial penalties being enforced by the Pension Regulator.

How to calculate pension contributions for auto enrolment?

Both the employer and employee must contribute a minimum percentage of these earnings into the pension scheme. The total minimum contribution is 8% of qualifying earnings, with at least 3% contributed by the employer and the remaining 5% by the employee (which may include tax relief).

Employers must use a compliant payroll system to calculate these contributions automatically, ensuring accuracy and compliance with regulations.

How does UK pension work for foreigners?

- Are aged between 22 and the State Pension age.

- Earn at least £10,000 per year in the UK.

Foreigners can also contribute to a personal pension or the UK State Pension if they meet National Insurance contribution requirements. The amount of State Pension they receive will depend on the number of qualifying years they have accrued through National Insurance contributions.

When leaving the UK, foreigners may still be able to claim their pension benefits upon retirement or transfer their pension savings to a recognised overseas pension scheme. Specific rules apply depending on their country of residence and tax treaties between the UK and their home country.